AML/CFT Compliance Software

1ST COMPLIANCE SOFTWARE OVERVIEW

1ST COMPLIANCE is a compliance and due diligence software tool that is developed to satisfy global regulatory standards for compliance and due diligence.

A group of professionals with varied backgrounds in law, compliance, and anti-financial crime joined together with a highly skilled technical team and developed the tool. Initially developed for internal use for the legal industry which spans in more than 15 countries, the tool was further modified with advanced technologies and industry knowledge to cover different industries where third-party risks are to be identified and monitored for due diligence and compliance requirements.

The technology facilitates precise investigations and exhaustive due diligence because of its demonstrated track record of involvement in regulatory agency compliance inspections, sophisticated transaction monitoring, and AI-powered unfavorable media screening. It offers smooth interaction with authorities and easy access to global data sources. The tool offers an infinite number of user-created places. By streamlining compliance management, 1ST COMPLIANCE keeps you ahead of future regulatory changes and lets you concentrate on your main business.

Key Features: All-in-One Command Centre

1ST Compliance – Why it stands out from other tools

| Features | 1ST COMPLIANCE | OTHER TOOLS IN THE MARKET |

|---|---|---|

| Designed by Industry Specialists | Expertise: Developed by a team of lawyers, compliance, and anti-financial crime, reflecting the highest industry standards. The Technical Team worked closely with the experts on the process, automation, and requirements Benefit: Your business is protected by solutions designed by experts in the field. | The majority of them are developed by general software developers and compliance and legal professionals are not involved extensively. |

| Comprehensive Compliance Workflow | Efficiency: We provide a streamlined compliance workflow that simplifies the management process and is Dynamic and 100% customizable. Benefit: Makes compliance management more efficient and effective. | Standard workflow features or advanced with manual processes. |

| Customizable Risk Intelligence | Personalization: Users can define their own risk rules based on any available data in the system. Benefit: Tailor the software to meet your specific risk management needs. | Predefined Risk Rules and limited to customization. |

| Advanced Transaction Monitoring | Capability: Our software includes powerful transaction monitoring to detect and prevent suspicious activities. Benefit: Enhances your ability to spot and address potential risks promptly. | Basic transaction monitoring to Robust monitoring with manual analytics. |

| AI-Powered Adverse Media Screening | Innovation: Utilizing AI technology, our adverse media screening offers enhanced due diligence and comprehensive risk assessment. Benefit: Ensures thorough and accurate screening to mitigate risks. | Basic media screening Advanced AI screening with similar capabilities but with additional costs. |

| Scalability with Unlimited Users and Locations | Flexibility: Our software supports unlimited user creation and access across multiple locations. Benefit: Facilitates your organization’s growth and scalability without constraints | Limited user and location support to Scalable but with additional costs. |

| E-KYC Integration | Efficiency: Incorporates electronic Know Your Customer (e-KYC) processes, allowing for seamless and secure digital identity verification. Benefit: Expedites client onboarding with digital verification methods, reducing manpower requirements and increasing efficiency. | Basic KYC integration to Advanced KYC, limited e-KYC options, but with additional costs |

Compliance with 1ST COMPLIANCE

- We tailor models and collaborate with industry consortiums to address your specific needs and industry challenges.

- Equips compliance officers (CO) with powerful tools to identify suspicious activity efficiently.

- Provides a framework for implementing systematic controls to effectively mitigate identified risks.

- 1ST COMPLIANCE delivering powerful intelligence that fuels better decision-making for businesses of all sizes and industries.

- We leverage our custom-built platform to process massive datasets, to identify financial crime and unearthing hidden connections and trends.

- Our patented linking technology identifies and connects seemingly disparate data points, revealing a clearer picture.

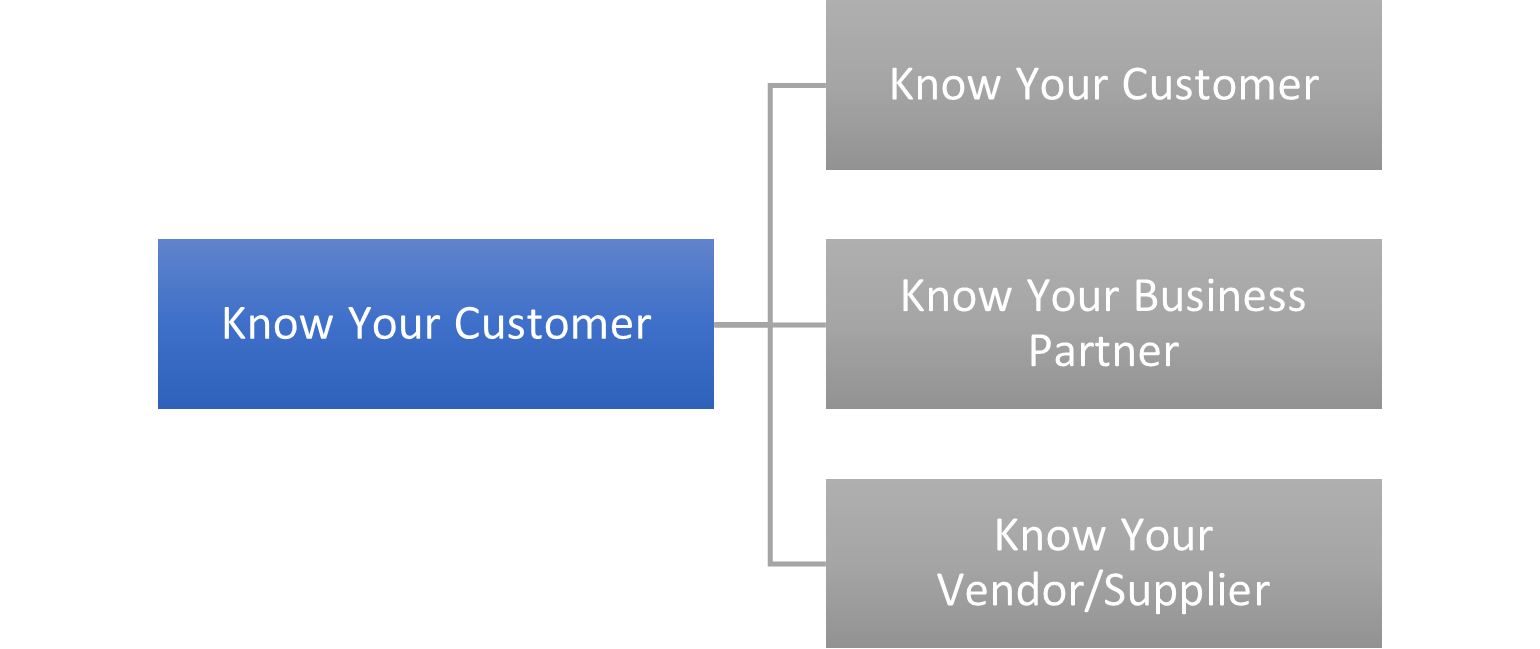

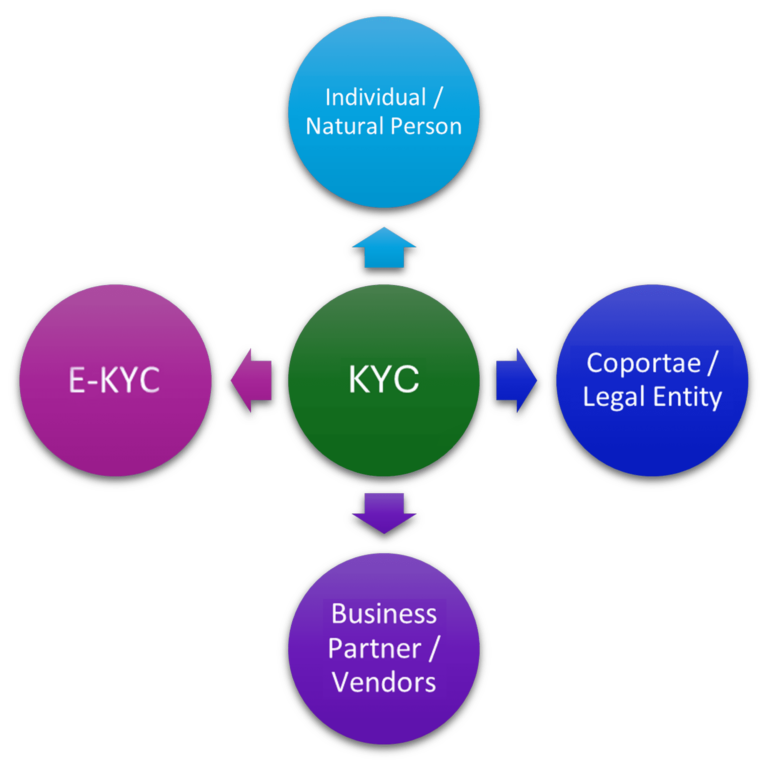

KYC Management for All Client Types

1ST COMPLIANCE simplifies and centralizes your KYC (Know Your Customer) management process, allowing you to efficiently onboard and monitor individuals, companies, and business partners.

- Legal Entities: Capture detailed business information, shareholder information for ownership transparency. Onboard senior management and authorized representatives with ease. Monitor the appointment and changes of company officers and signatories.

- Individual Clients: Collect and verify individual details, including business and professional information.

- Business Partners & Service Providers, Vendors and Suppliers: Onboard key personnel within your partner and service provider organizations. Monitor changes in their senior management, representatives, and authorized signatories.

- E KYC: Electronic Know Your Customer (EKYC) form is to digitally onboard, the customers or clients, ensuring compliance with regulatory requirements and reducing the risks associated with money laundering, fraud, and other financial crimes.

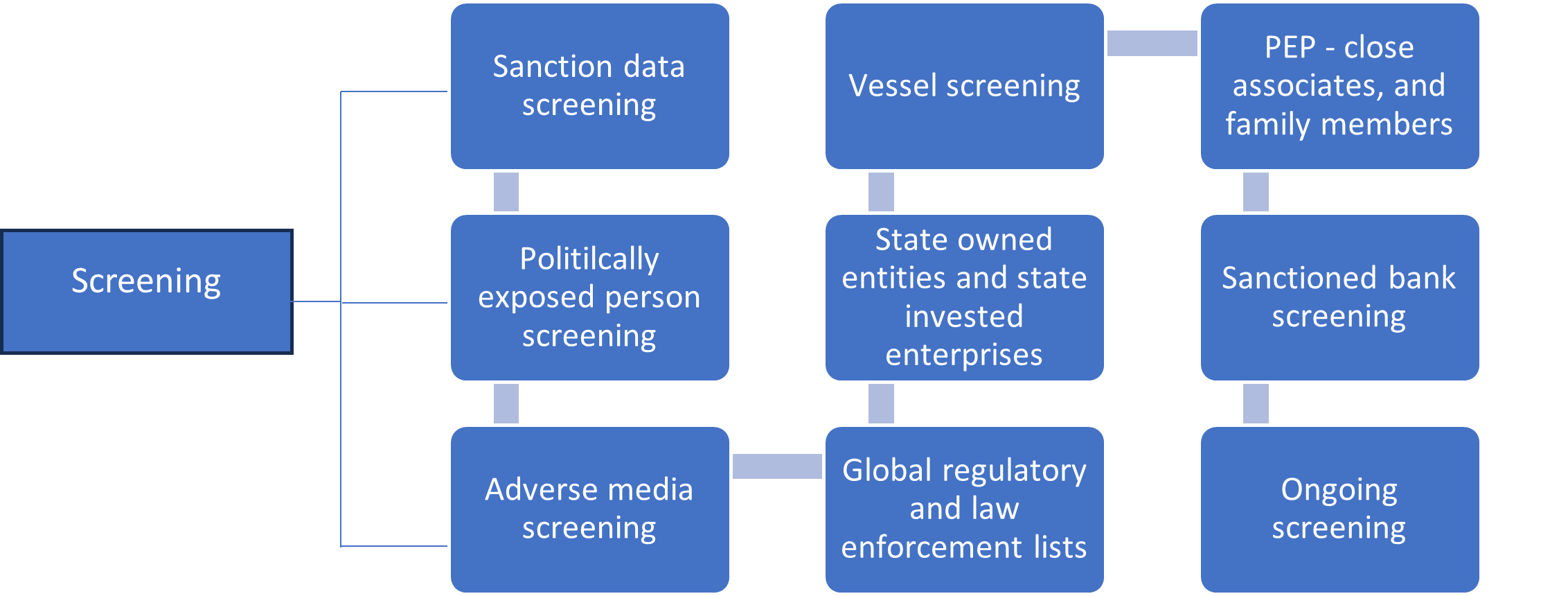

Sanction and Politically Exposed Person (PEP) Screening

Our proprietary algorithms and artificial intelligence do all the hard work, ensuring the customer enjoys the smoothest experience possible.

- Extensive Data Integration: Integrates with major sanction, PEP (Politically Exposed Person), and adverse media databases containing over 5.5 million records.

- Streamlined Onboarding with Pre-Screening: Perform quick and efficient client checks before onboarding using the pre-screening functionality.

- Automated KYC Screening: Automatically screens clients against sanction lists, PEP databases, and adverse media during onboarding, ensuring compliance with Know Your Customer (KYC) regulations.

- Continuous Transaction Monitoring: 1ST COMPLIANCE goes beyond onboarding with ongoing transaction screening. It monitors every transaction against international compliance standards to identify potentially suspicious activity.

- Scheduled Periodic Reviews: Schedule regular automated reviews of your organization’s data to identify any newly identified sanctions, PEPs, or partial name matches. The system automatically escalates these cases to your compliance case management system for further investigation.

- Internal watch list management: Provides the capability to add internal watch list data to comply with mandatory requirements.

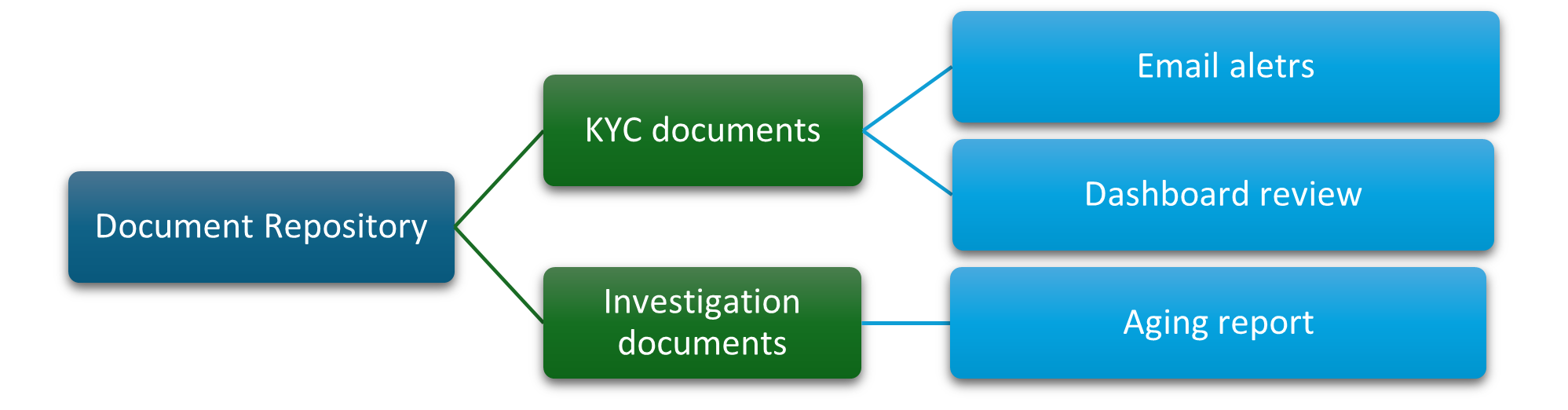

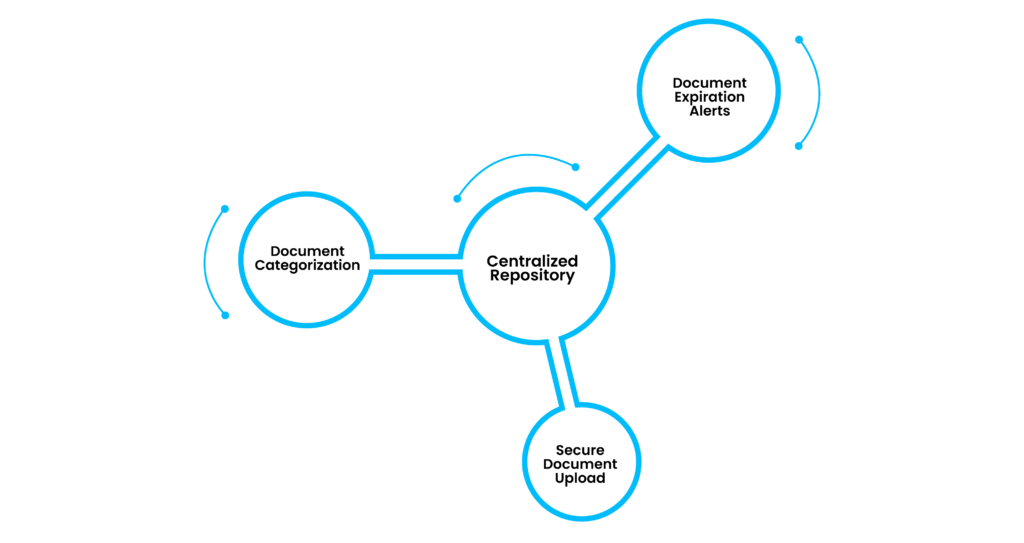

Streamlined KYC Document Management

1ST COMPLIANCE simplifies and centralizes your Know Your Customer (KYC) document management process for your clients, eliminating the need for physical paperwork and streamlining audit preparation.

- Secure Document Upload: Eliminate the need for physical storage by securely uploading all KYC documents directly into the system and ensures easy access and retrieval of critical customer information whenever needed.

- Automated Expiration Alerts: Never miss a renewal again. 1ST COMPLIANCE automatically sends you notification alerts which help you stay proactive in maintaining compliance with KYC regulations.

- Centralized Repository: Securely store and manage all your KYC documents in a centralized platform.

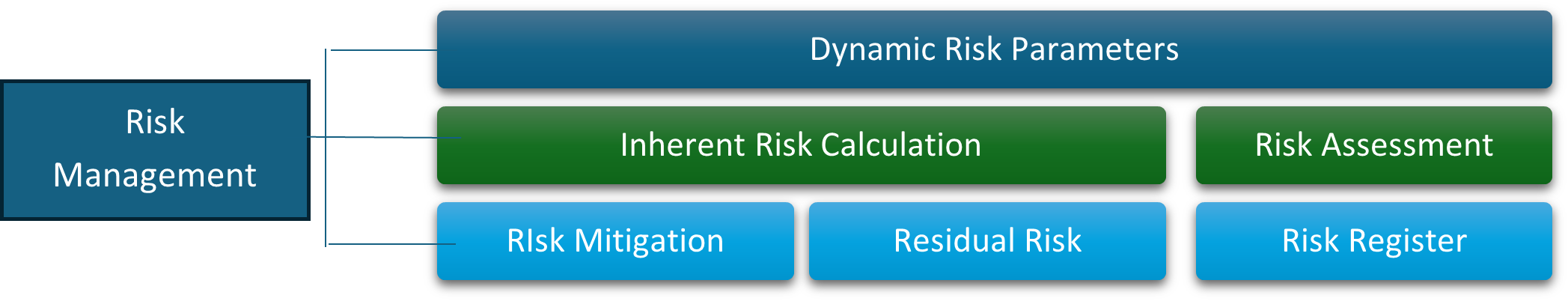

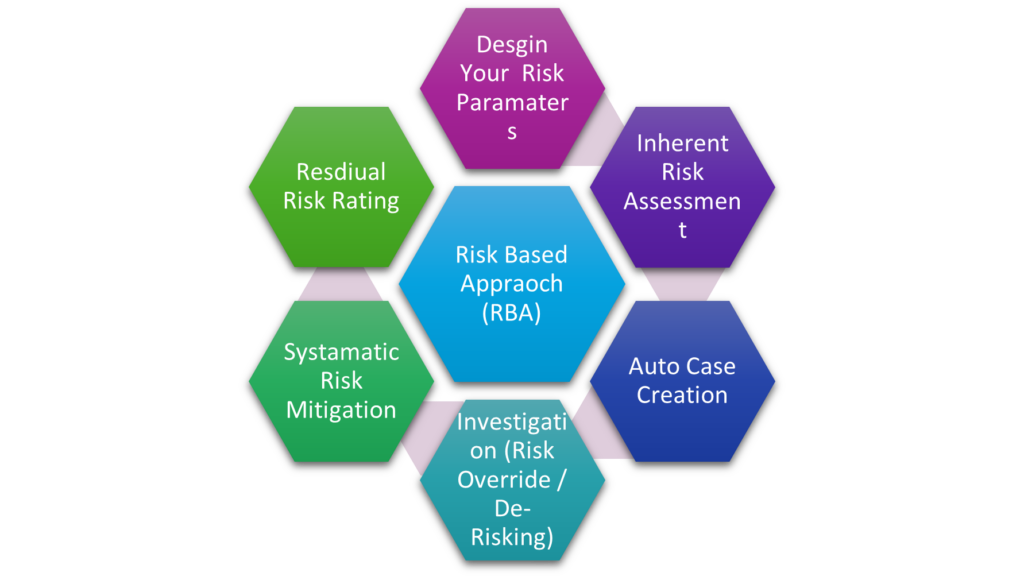

AML-CFT Risk Management

1ST COMPLIANCE empowers you to take control of your risk assessment with its dynamic risk management function. This feature allows for proactive risk management, enabling you to identify, assess, and mitigate risks effectively, ensuring smarter and more informed due diligence processes.

- Customize Your Framework: Tailor your risk assessment criteria based on your specific needs and industry.

- Prioritize Effectively: Focus on the most relevant risk categories to streamline your due diligence process and optimize resources.

- Identify Hidden Threats: Uncover potential customer risks before they impact your business. Gain insights into criminal history, high-risk professions and industries, financial crime discrepancies, and geographic risk factors.

- Systematic Risk Mitigation: Move from reactive risk management to a proactive approach. Your risk will be mitigated through secure due diligence measures provided by 1ST COMPLIANCE. This comprehensive approach ensures that potential risks are identified, assessed, and managed effectively, providing your organization with a robust framework to maintain compliance and security.

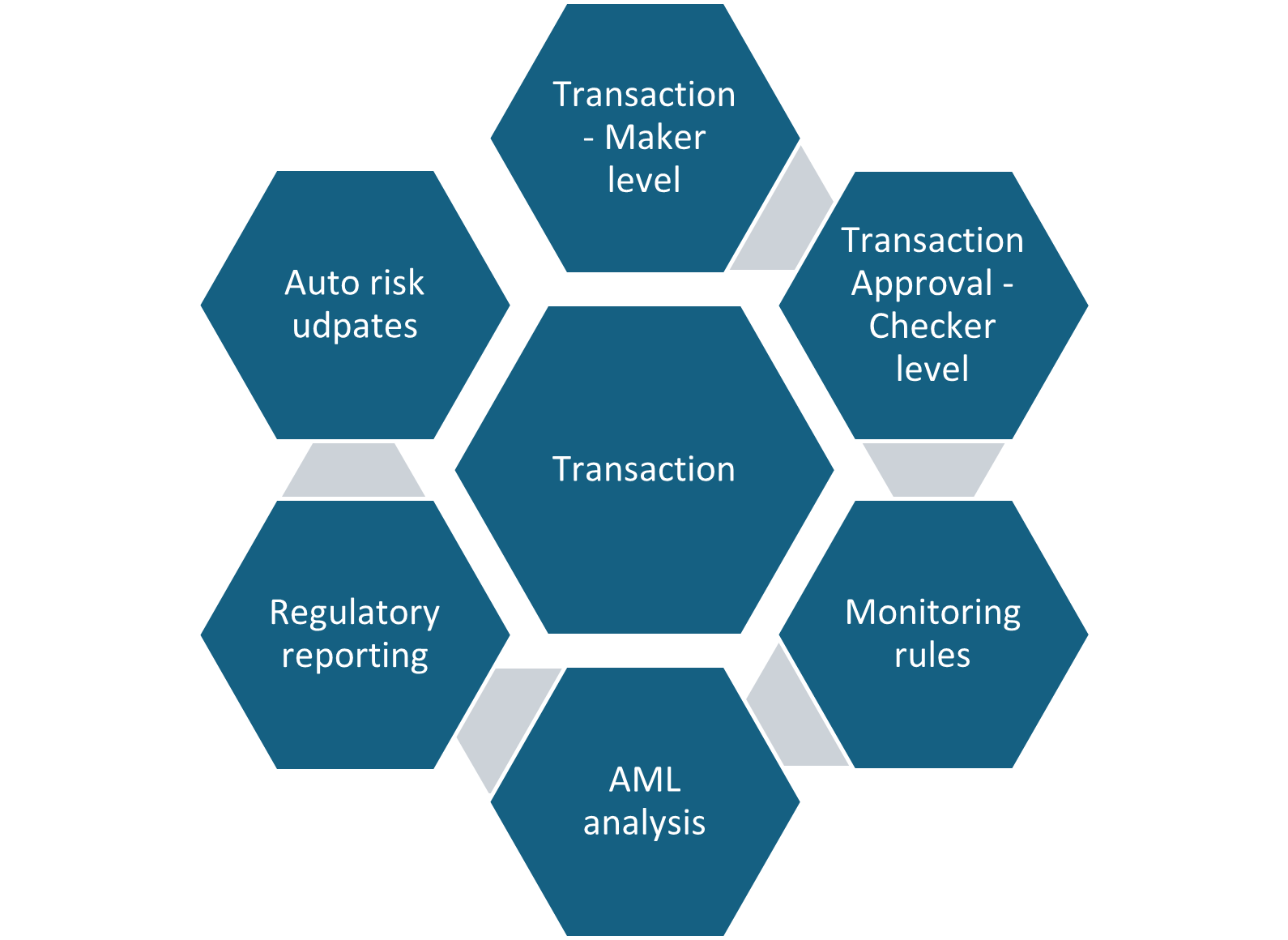

Transaction Management and Effortless GoAML Reporting

1ST COMPLIANCE simplifies managing your transactions and ensures seamless compliance with GoAML reporting requirements.

- Centralized Transaction Management: Record and monitor all your transactions within the platform.

- Automated GoAML Report Generation: Automates the process of generating GoAML reports. The software can download and format your transaction data according to specific GoAML reporting formats for:

- Cash Transaction Reports (CTR)

- Real Estate Activity Reports (REAR)

- Reports for Dealers in Precious Metals and Stones (DPMS)

- Other GoAML reporting requirements (as applicable)

- Save time and resources by managing transactions and generating reports within a single platform.

- Automated report generation minimizes the risk of errors and ensures data consistency.

- Maintain a clear audit trail of all transactions and associated reports.

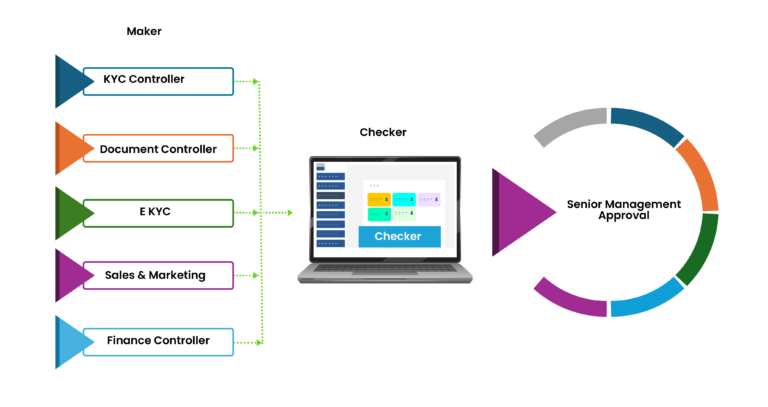

The Power of Teamwork for Stronger Compliance: Multi-Level Approval

1ST COMPLIANCE prioritizes robust compliance by incorporating a multi-level approval process built on the maker-checker (four-eye) principle. This collaborative approach ensures that critical actions, from onboarding new clients to monitoring transactions and ongoing risk assessments, are subject to thorough review and approval by designated personnel.

- Enhanced Accuracy: Multiple reviewers involved in the process minimize the risk of errors during onboarding and data entry.

- Protects against compliance violations: This safeguards against inaccurate information entering your system and protects against potential compliance violations.

- Fraud Prevention: By requiring approval for high-value or suspicious transactions, the system acts as a safeguard against unauthorized or fraudulent activities.

- Clear Accountability: The multi-level approval process establishes a clear chain of command, ensuring everyone involved understands their responsibilities which promotes accountability and facilitates a more transparent compliance environment.

1ST COMPLIANCE allows you to tailor the approval process to your organization’s needs and risk tolerance. For example, low-risk transactions may require approval from a single reviewer, while high-risk transactions may require approval from multiple reviewers at different levels.

User Management for Enhanced Security and Control

1ST COMPLIANCE empowers you with robust user management features to ensure secure access and prevent internal fraud.

- Unlimited User Creation: Scale your team seamlessly by creating an unlimited number of user accounts.

- Role-Based Access Control (RBAC): Define custom user roles with specific access rights to various functions within the software, this ensures users can only perform actions relevant to their roles.

- Location-Based Access Controls: For added security, you can configure location-based access restrictions.

- Reduced Risk of Fraud: Prevent unauthorized access and internal fraud by restricting user permissions based on roles and responsibilities.

- Enhanced Data Security: Ensure sensitive information is only accessible to authorized personnel.

- Improved Operational Efficiency: Streamline workflows by assigning users specific permissions relevant to their tasks.

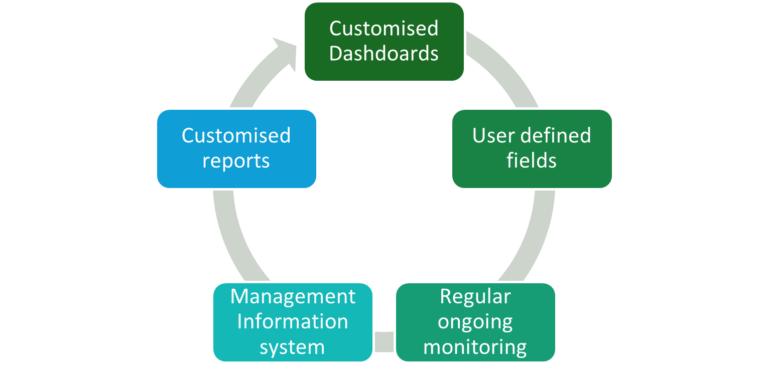

Proactive Monitoring Tools

- Set for Ongoing Monitoring Profiles: Proactively identify potential issues with designated customer profiles for ongoing monitoring.

- Profiles Under Investigation Analysis: Gain real-time insights into ongoing investigations and track their progress towards resolution.

- Heightened Monitoring Profiles: Monitor and manage high-risk profiles that require close attention and potential mitigation strategies.

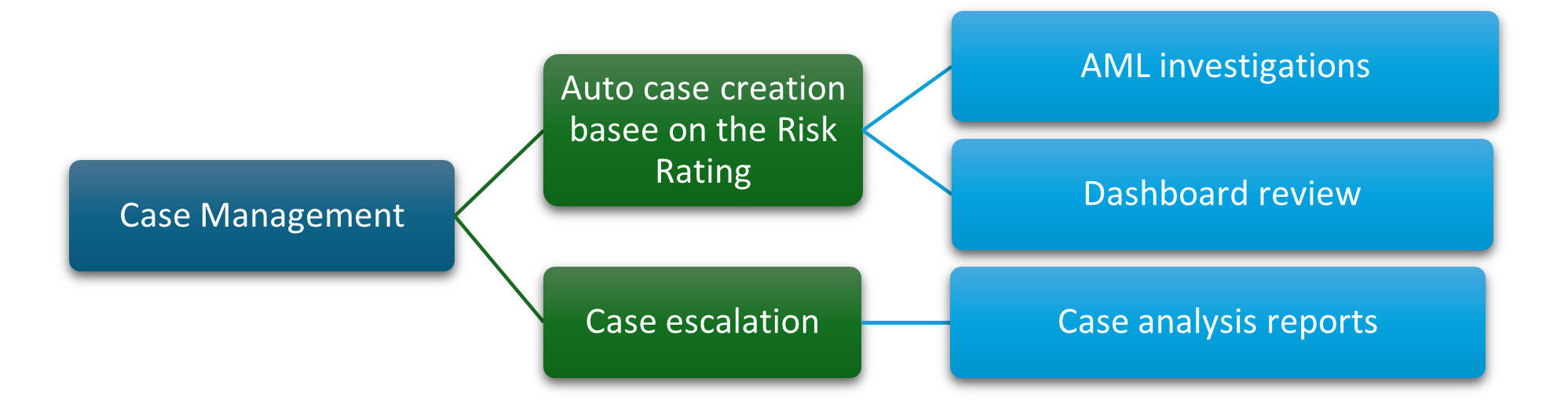

AML-CFT Compliance and Case Management

1ST COMPLIANCE streamlines and strengthens your Compliance (AML/CFT (Anti-Money Laundering/Combating the Financing of Terrorism) compliance efforts with a comprehensive suite of tools.

- Case Management for Investigations: Manage all your AML/CFT investigations and reporting activities within a centralized platform, which eliminates the need for disparate spreadsheets and paper trails, enhancing efficiency and streamlining communication.

- AI-Powered Risk Scoring and Case Escalation: 1ST COMPLIANCE leverages advanced AI (Artificial Intelligence) to analyse customer data and transactions. When potential red flags are identified, the software automatically escalates the case to the compliance department for further investigation.

- Seamless Internal Communication: Facilitate seamless communication between compliance, operations, and management teams.

- Data-Driven Decision Making: 1ST COMPLIANCE provides all relevant case information, investigation details, and risk scoring data in a single location. This empowers compliance officers to make informed decisions regarding high-risk scenarios, supported by data and insights.

Simplify compliance with 1ST COMPLIANCE, built to meet the latest national and international regulations.

Empowering Compliance Professionals for a Secure Future

In today’s regulatory requirements, compliance professionals face the ongoing challenge of maintaining a robust compliance culture. 1ST COMPLIANCE is a tailored software solution designed to empower your compliance team with advanced tools and automation, enabling them to excel in their roles.

- Improve Decision-Making: Make informed decisions based on real-time data and comprehensive risk analysis, reducing the risk of compliance violations.

- Enhance Efficiency: Eliminate manual processes and streamline workflows, allowing your compliance team to accomplish more in less time.

- Boost Confidence: Work with confidence knowing they have the tools and resources needed to effectively manage compliance risks and safeguard your organization.

- Reduced Compliance Costs: Optimize your compliance resources by focusing investigations on high-risk cases identified by AI.

- Improved Risk Management: Proactively identify and address potential risks before they impact your business.

- Strong Compliance: Demonstrate a strong compliance posture with a clear audit trail of your due diligence activities and case management.

1ST COMPLIANCE goes beyond automation. It empowers your compliance team to become a strategic asset for your organization.

Stay Informed with Customizable Alerts

- Adverse News Alerts: Be notified of negative news or reputational risks associated with your customers.

- Sanction Alerts: Get instant notifications when a customer matches a sanction list.

- PEP Alerts: Receive alerts when onboarding or monitoring customers identified as Politically Exposed Persons (PEPs).

- Risk-Based Alerts: Identify suspicious transactions based on pre-defined risk parameters.

- Threshold-Based Alerts: Get notified when transactions exceed pre-set thresholds.

- KYC Document Expiry Alerts: Receive timely reminders before KYC documents expire, ensuring continuous compliance.

- Monitoring Rule-Based Alerts: Stay informed of potential issues identified through ongoing monitoring activities.

Powering Up Your Compliance with Powerful Integrations

1ST COMPLIANCE seamlessly integrates with your existing system to streamline workflows and enhance your compliance efforts.

Error Checking and Data Validation

Diligence Onboard performance data validation checks during the upload process to identify and address any inconsistencies or errors before proceeding.

Bulk Data Screening

Screen large volumes of customer data against watchlists, sanction lists, and other relevant database to ensure compliance with AML/CFT regulations.

API Integration

Connect Diligence onboard with your core business system(CRM, ERP, Accounting Software) through APIs(Application Programming Interfaces).

Enhanced Efficiency

API integrations eliminate manual data transfer and duplication of effort, saving you valuable time and resources.

Bulk Data Uploaded

Onboard large numbers of customers efficiently with Diligence Onboard bulk data upload functionality.

Summary

- 1ST COMPLIANCE delivering powerful intelligence that fuels better decision-making for businesses of all sizes and industries.

- We leverage our custom-built platform to process massive datasets, to identify financial crime and unearthing hidden connections and trends.

- Advanced Linking Technology: Our patented linking technology identifies and connects seemingly disparate data points, revealing a clearer picture.

- Customizable Solutions and Industry Expertise: We tailor models and collaborate with industry consortiums to address your specific needs and industry challenges.