Compliance Scrutiny: Insurance Sector Under AML Scrutiny by CBUAE: A Wake-Up Call for UAE Insurance Providers

A New Era of Compliance for UAE Insurance Providers.

For years, banks and exchange houses were the central focus of anti-money laundering (AML) compliance. But change is in the air. The Central Bank of the UAE (CBUAE) is turning its attention to a new player: the insurance sector.

This isn’t just routine supervision—it’s a full-scale AML/CFT compliance wake-up call for life insurance providers and policy issuers across the Emirates. If you’re in the business of insurance, here’s what you need to know—and what to do next.

Why Is the Insurance Sector Under the CBUAE’s Radar?

While insurance may not involve daily transactions like banks, certain policies—especially life insurance—can be misused to clean dirty money. The FATF has specifically identified insurance products with early surrender clauses, high payout amounts, and international transfers as red flags for potential money laundering and terrorist financing.

The CBUAE is acting on this global insight—tightening oversight and expecting robust compliance frameworks from insurers.

Top AML Risk Factors in the Insurance Sector

1. Customer Onboarding Gaps

Poor KYC procedures are often the first failure point. Insurers that do not validate customer identities properly or skip detailed risk assessments are at risk of onboarding clients with illicit motives.

Best practice: Integrate AI-powered KYC tools that verify documents, screen sanctions/PEP lists, and assign risk scores in real time.

2. Suspicious Transaction Monitoring

Unusual top-ups, early policy cancellations, or payouts to third parties can all signal laundering attempts. Yet most insurance firms don’t have the same real-time monitoring systems banks do.

Fix it: Deploy smart transaction monitoring that detects behavioral anomalies, not just thresholds.

3. Product Misuse Risks

Flexible insurance products like ULIPs or investment-linked plans can function like financial accounts—making them perfect vehicles for fund layering.

Pro tip: Assign risk scores to each product based on liquidity, payout size, and customer behavior.

4. Reporting & Recordkeeping Failures

Even if your AML system is airtight, missing records or late SAR filings can still land you in trouble. The CBUAE expects:

- Timely suspicious activity reports (SARs)

- 5+ years of stored compliance records

- Transparent and updated policy documents

Solution: Automate compliance workflows with clear audit trails using a centralized AML platform.

How First Compliance Simplifies AML for Insurers

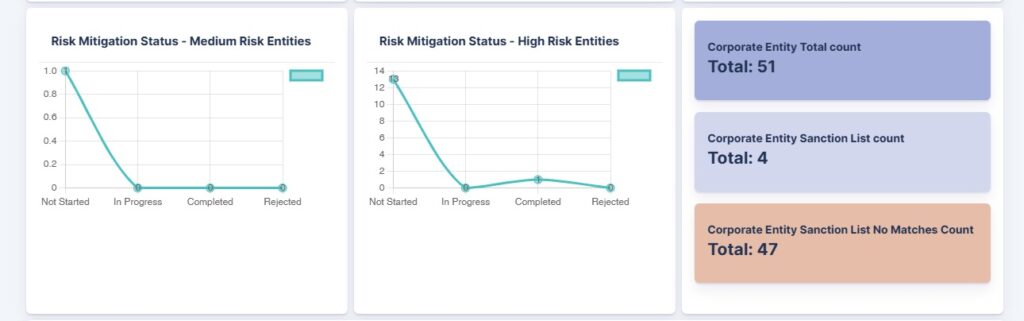

First Compliance is purpose-built to help UAE insurers meet AML/CFT standards without draining time or resources.

Key Features:

- Real-time customer risk profiling

- Integrated KYC and transaction monitoring

- Auto-generated audit reports and SARs

- Alerts for non-compliance or data gaps

- Cloud-based access with enterprise-grade security

Whether you’re a lean startup or a large insurer, First Compliance ensures you’re always inspection-ready.

Final Thoughts

The CBUAE’s move to supervise the insurance sector is more than a regulatory update—it’s a paradigm shift. AML/CFT compliance is now core to operating as a trusted, future-proof insurer in the UAE.

Don’t wait for an audit to fix your gaps. Take control, adopt the right tools, and build a culture of proactive compliance.

📞 Ready to Future-Proof Your Insurance Business?

👉 Book a Free Demo with First Compliance

Let our experts show you how to stay ahead of AML challenges—efficiently, affordably, and confidently.