Insurance brokers and Providers

Guide to Navigating the AML Health Check

Let’s be honest — keeping up with AML compliance can feel like trying to solve a puzzle where the pieces keep changing shape. Insurance brokers and insurers face tons of rules that seem to pile up overnight. But this isn’t just about ticking boxes on a checklist. It’s about protecting your business from serious risks like money laundering and heavy penalties nobody wants to deal with.

At Adil Zone, we understand that. We want you to see compliance checks for what they really are: a way to spot weak spots before they turn into big problems. Think of it as a regular health check-up — but for your company’s defenses against financial crime.

What Exactly Is an AML Health Check?

Think of your company getting a thorough physical exam. That’s basically what an AML health check is — a detailed review of your current policies and procedures compared against the latest rules and best practices.

It’s not about scrambling to catch up after a surprise inspection. It’s about staying ahead of the game. Finding those little gaps early means you can fix them before they become costly fines or damage your reputation.

Learn more about our Compliance Services to stay proactive.

What an AML Health Check Looks Into

A good AML health check dives into several important areas to give a full picture of your compliance, including:

- Customer Due Diligence (CDD) and Know Your Customer (KYC) — How well do you verify who your customers are? Do you know what risks they might bring?

- Transaction Monitoring — Are you spotting suspicious moves before they slip through the cracks?

- Risk Assessments — Do you understand the risks linked to different products, customers, and regions?

- Staff Training — Are your team members clear on their AML duties?

- Reporting and Record-Keeping — Are you keeping the right documents and filing reports on time?

You can get detailed insights on these areas by checking our AML Gap Analysis service.

Why Do Regular AML Health Checks Pay Off?

Doing regular checks doesn’t just keep regulators off your back. It makes your life easier. Here’s how:

- You catch problems early before they turn into fines or legal headaches.

- You make your compliance processes smoother and save time.

- You build a company culture that’s alert and responsible.

- You reduce risks connected to money laundering.

The Roadblocks and How to Dodge Them

Let’s face it, compliance can be a headache. Rules change all the time, and insurance products come with all kinds of risks that need different approaches.

The key is staying ahead. Keep your policies fresh, do internal mock audits now and then, and don’t hesitate to get expert help. Waiting for an official audit to find gaps? That’s just asking for trouble.

Getting Ready for Your AML Health Check

Here’s a quick to-do list to help you get ready:

- Keep your AML policies up to date.

- Run internal checks and mock audits regularly.

- Train your staff on AML rules.

- Work with experts who can offer tailored advice.

At Adil Zone, we’re all about making this easier for you by offering clear advice and practical solutions.

Ready to Take the Next Step?

Don’t just identify compliance gaps — close them.

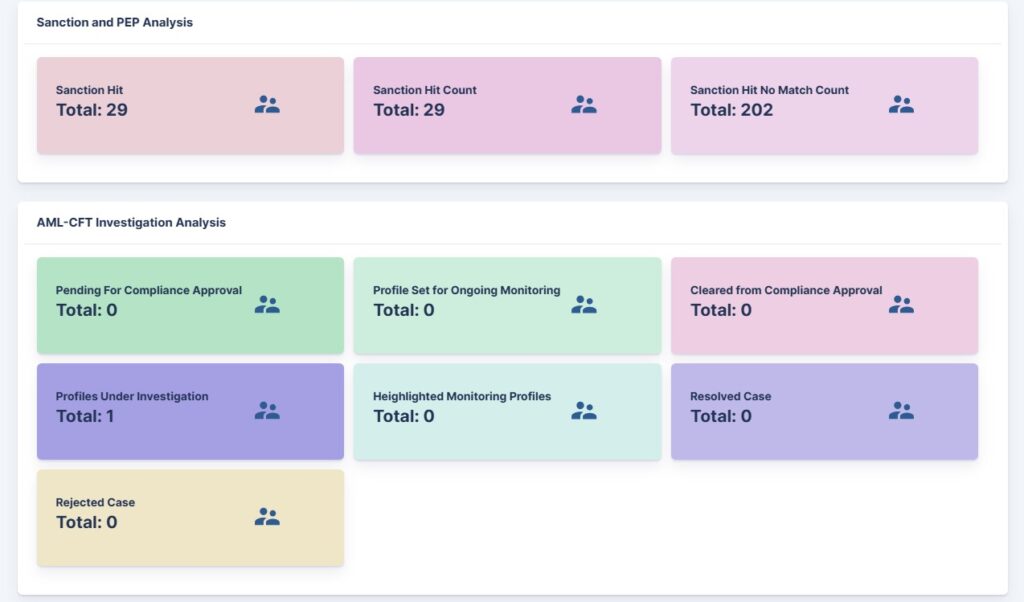

At Adil Zone, we go beyond audits. With our tailored AML consultancy services and our powerful compliance management platform, First Compliance, we help UAE insurance brokers and insurers build airtight, regulator-ready frameworks.

✅ First Compliance gives you:

Real-time compliance tracking

Automated documentation and audit trails

Integrated AML/CFT monitoring tools

UAE regulation-specific templates and workflows

Whether you’re preparing for a regulatory inspection or just want to sleep better at night, we’ve got you covered.

Let’s future-proof your business — starting today.

👉 Contact Adil Zone to schedule your AML Health Check

👉 Learn more about First Compliance

Wrapping Up — Strong Compliance Means a Stronger Business

AML compliance isn’t a one-time thing. It’s an ongoing journey that keeps your business safe and your reputation solid.

At Adil Zone, we don’t just tick boxes. We partner with you to build a culture of trust and vigilance. Want to stay ahead and keep your business secure? Get in touch with our AML experts today. We’ve got your back.