1ST Compliance Software

1ST Compliance Software Overview

1st COMPLIANCE is a compliance and due diligence software tool that is developed to satisfy global regulatory standards for compliance and due diligence.

A group of professionals with varied backgrounds in law, compliance, and anti-financial crime joined together with a highly skilled technical team and developed the tool. Initially developed for internal use for the legal industry which spans in more than 15 countries, the tool was further modified with advanced technologies and industry knowledge to cover different industries where third-party risks are to be identified and monitored for due diligence and compliance requirements.

The technology facilitates precise investigations and exhaustive due diligence because of its demonstrated track record of involvement in regulatory agency compliance inspections, sophisticated transaction monitoring, and AI-powered unfavorable media screening. It offers smooth interaction with authorities and easy access to global data sources. The tool offers an infinite number of user-created places. By streamlining compliance management, 1ST COMPLIANCE keeps you ahead of future regulatory changes and lets you concentrate on your main business.

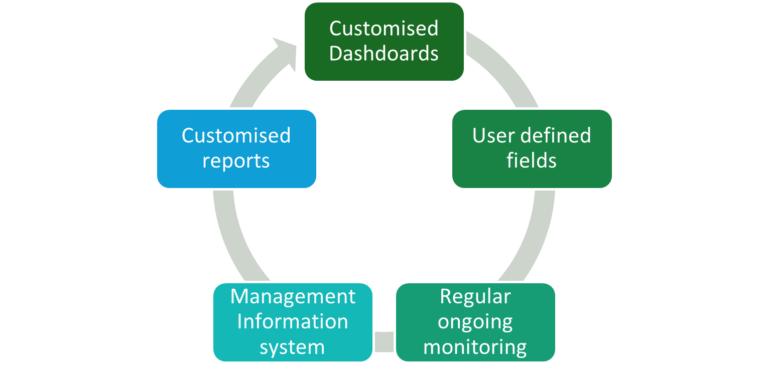

Key Features: All-in-One Command Centre

1st Compliance – Why it stands out from other tools

| Features | 1ST COMPLIANCE | OTHER TOOLS IN THE MARKET |

|---|---|---|

| Designed by Industry Specialists |

Expertise: Developed by a team of lawyers, compliance, and anti-financial crime, reflecting the highest industry standards. The Technical Team worked closely with the experts on the process, automation, and requirements

Benefit: Your business is protected by solutions designed by experts in the field. |

The majority of them are developed by general software developers and compliance and legal professionals are not involved extensively. |

| Comprehensive Compliance Workflow |

Efficiency: We provide a streamlined compliance workflow that simplifies the management process and is Dynamic and 100% customizable.

Benefit: Makes compliance management more efficient and effective. |

Standard workflow features or advanced with manual processes. |

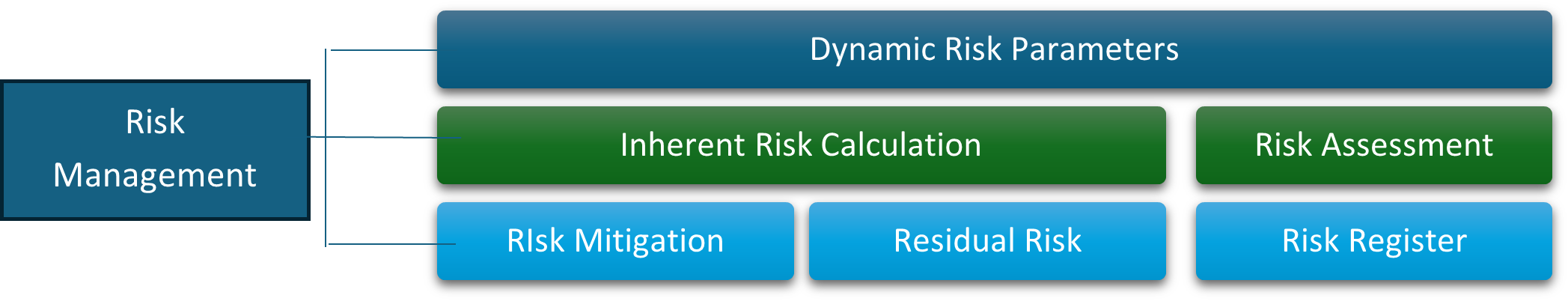

| Customizable Risk Intelligence |

Personalization: Users can define their own risk rules based on any available data in the system. Benefit: Tailor the software to meet your specific risk management needs. |

Predefined Risk Rules and limited to customization. |

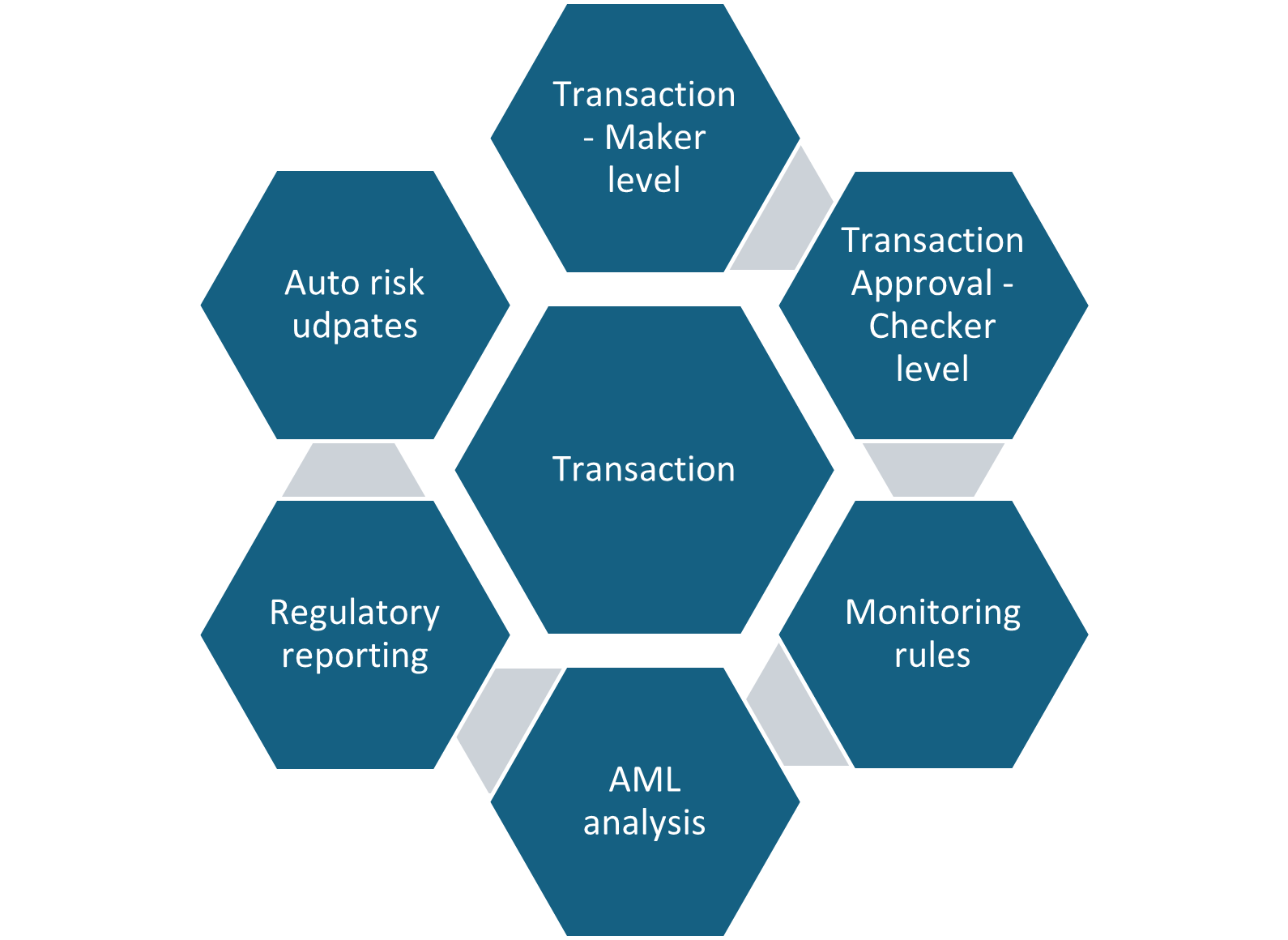

| Advanced Transaction Monitoring |

Capability: Our software includes powerful transaction monitoring to detect and prevent suspicious activities.

Benefit: Enhances your ability to spot and address potential risks promptly. |

Basic transaction monitoring to Robust monitoring with manual analytics. |

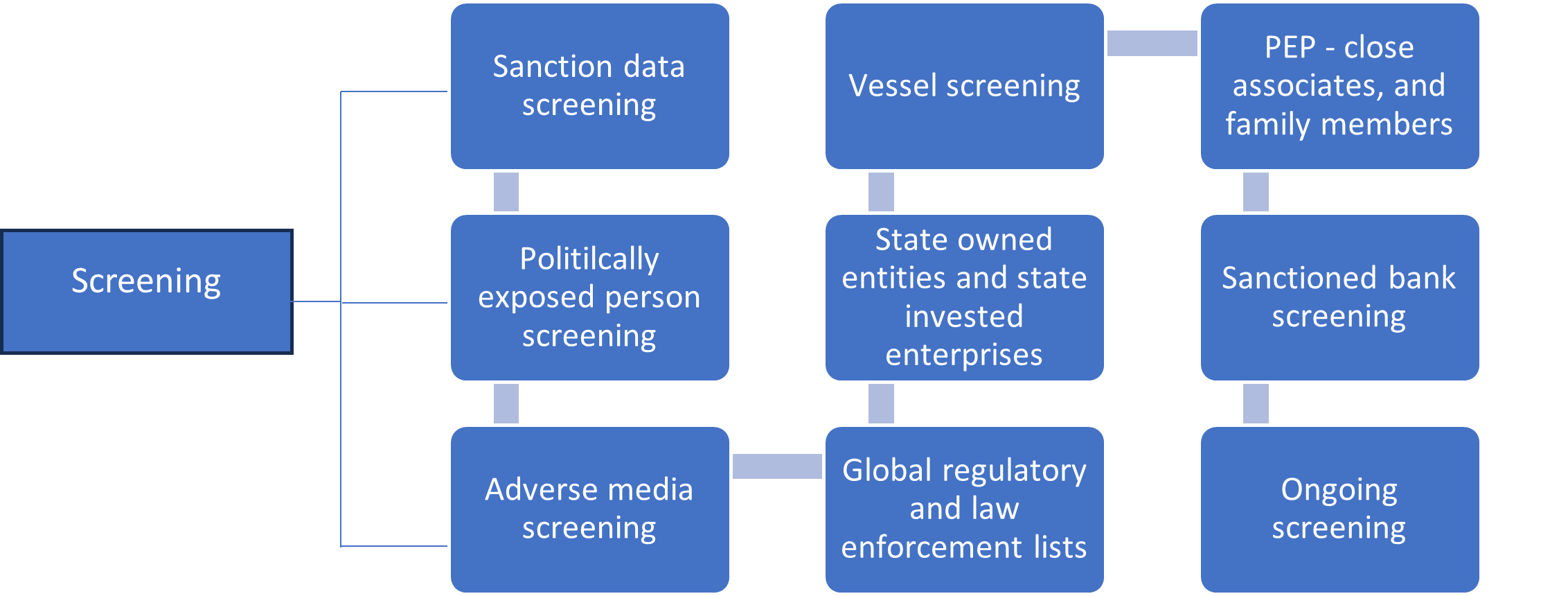

| AI-Powered Adverse Media Screening |

Innovation: Utilizing AI technology, our adverse media screening offers enhanced due diligence and comprehensive risk assessment.

Benefit: Ensures thorough and accurate screening to mitigate risks. |

Basic media screening Advanced AI screening with similar capabilities but with additional costs. |

| Scalability with Unlimited Users and Locations |

Flexibility: Our software supports unlimited user creation and access across multiple locations.

Benefit: Facilitates your organization’s growth and scalability without constraints |

Limited user and location support to Scalable but with additional costs. |

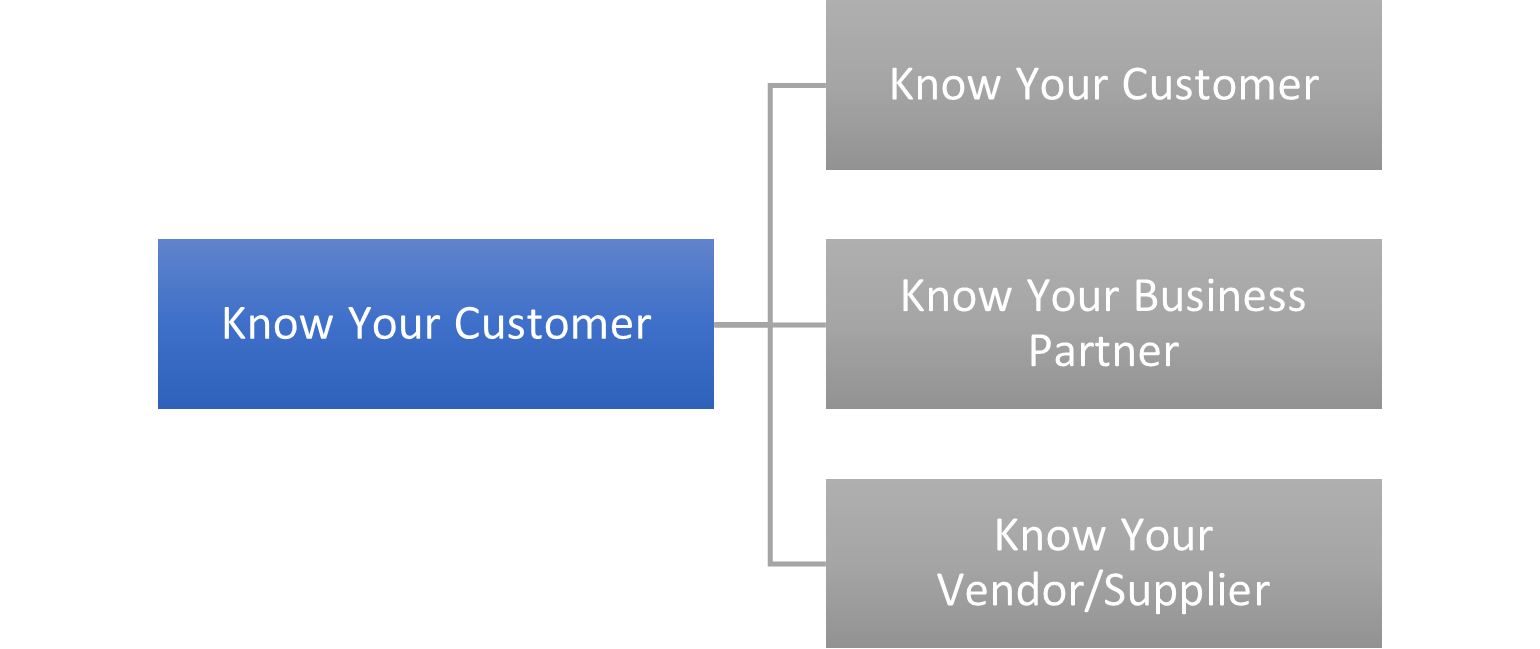

| E-KYC Integration |

Efficiency: Incorporates electronic Know Your Customer (e-KYC) processes, allowing for seamless and secure digital identity verification.

Benefit: Expedites client onboarding with digital verification methods, reducing manpower requirements and increasing efficiency. |

Basic KYC integration to Advanced KYC, limited e-KYC options, but with additional costs |

Powering Up Your Compliance with Powerful Integrations

1ST COMPLIANCE seamlessly integrates with your existing system to streamline workflows and enhance your compliance efforts.

Error Checking and Data Validation

Diligence Onboard performance data validation checks during the upload process to identify and address any inconsistencies or errors before proceeding.

Bulk Data Screening

Screen large volumes of customer data against watchlists, sanction lists, and other relevant database to ensure compliance with AML/CFT regulations.

API Integration

Connect Diligence onboard with your core business system(CRM, ERP, Accounting Software) through APIs(Application Programming Interfaces).

Enhanced Efficiency

API integrations eliminate manual data transfer and duplication of effort, saving you valuable time and resources.

Bulk Data Uploaded

Onboard large numbers of customers efficiently with Diligence Onboard bulk data upload functionality.

Compliance with 1ST COMPLIANCE

- We tailor models and collaborate with industry consortiums to address your specific needs and industry challenges.

- Equips compliance officers (CO) with powerful tools to identify suspicious activity efficiently.

- Provides a framework for implementing systematic controls to effectively mitigate identified risks.

- 1ST COMPLIANCE delivering powerful intelligence that fuels better decision-making for businesses of all sizes and industries.

- We leverage our custom-built platform to process massive datasets, to identify financial crime and unearthing hidden connections and trends.

- Our patented linking technology identifies and connects seemingly disparate data points, revealing a clearer picture.